To keep records and confirm the fact of purchase, a special document is used, which is called a sales receipt. When might it be needed? How to fill in correctly? Do I need to print? Below you will find the answers to these questions.

When is a sales receipt needed?

A sales receipt (TC) is a special accounting document that contains basic information about a purchase. In its main properties, it is similar to a cash receipt, but only information about the time and place of purchase is indicated in the cash register paper. PM is more detailed, and both of these documents must be attached to the financial report.

TC is issued to the buyer upon request, while the cash accounting document must be attached to the financial report without fail. Sometimes TC is issued to the buyer in order to avoid disagreements and disputes if the party has claims. In the case of organizations, the PM is printed using a cash register, while in the case of an individual entrepreneur, it can be both printed and handwritten.

Filling order

In the laws of the Russian Federation there is no clear instruction that regulates the procedure for filling out. But the following information should be indicated in the TC:

- Name.

- Individual number and exact print time.

- The short name of the person who trades (for legal entities - the name of the organization, for individual entrepreneurs - the full name of the businessman).

- Registration number (for organizations) or TIN (for individual entrepreneurs).

- Full address of the trading platform.

- Name, quantity and value of items.

- Total cost.

- Surname, name and signature of the employee.

- Stamp (if any).

Do you need a print?

You may not print. This rule applies to both organizations and individual entrepreneurs. But some lawyers still recommend putting a stamp, since the seal is an additional guarantee of the purity of the transaction, since it confirms the fact of buying this or that thing from a particular entrepreneur. For example, a person bought a product in a store, but it turned out that the item contains many hidden defects. Then you can exchange the defective product with the help of PM, and the stamp will act as solid evidence that the item was purchased in this particular store.

Can I use a sales receipt without a cash receipt?

PM can be used without a cash register if the point is not equipped with such a device, and the businessman himself works under a special tax regime (UTII, "simplified" and so on). All accounting activities are carried out using PM, written by hand. Also, the seller must correctly keep records and submit reports to the tax authorities on time. At the request of the buyer, the seller is obliged to hand him a check written by hand, but the issuance of this certificate does not exempt the seller from paying taxes.

For IP

TC is issued both by a legal entity and an individual entrepreneur. If an individual entrepreneur does not have a cash register, then he can issue a TC independently by hand or using a computer. If necessary, the entrepreneur is obliged to issue it to the buyer. At the same time, the laws of the Russian Federation oblige a businessman to include certain mandatory information in such a document, and their absence is considered a violation of the law on trade and entrepreneurial activity. All checks must contain the following information:

- Name.

- Full name of the businessman and his TIN.

- Number.

- Date and time of sale.

- Basic information about things (name, quantity and cost).

- Total price.

- Seller's signature.

- IP stamp (if any).

If the above information is included in the accounting paper, then it can be recognized as a sales receipt, otherwise it will not have legal force.

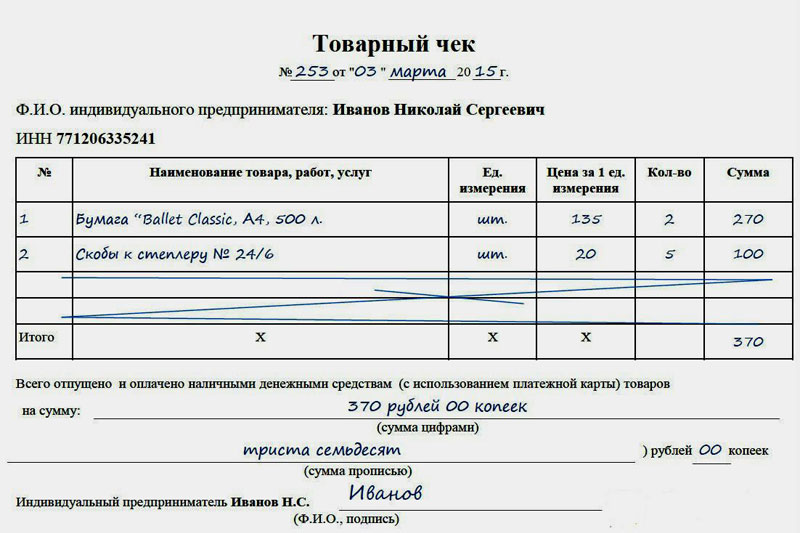

Fill example (sample)

With its help, you will understand how to fill out the check correctly and what information you need to indicate in one or another paragraph. It is recommended to make it on hard cardboard, and on the back of the document it is allowed to place an advertisement for a retail outlet or an enterprise. The PM is usually filled in as follows:

- on the top left, information about the individual entrepreneur, his TIN, as well as the number and address of the store are indicated;

- the exact date and time of issue is written at the top right;

- number is indicated in the center;

- under the number in the center are information about all purchased items in the form of a table;

- the total amount is indicated at the bottom right;

- at the bottom left, the seller indicates the full name, and also puts a signature (optionally, the IP seal is put here).

Sales receipt template

Sales receipt template Conclusion

A sales receipt is a special document that contains information about a purchase. It also contains the date of the trading operation, data about the trader. It is used for accounting, but upon request, it must be transferred to the buyer to confirm the purchase. Usually this paper is printed using a cash register, however, in some cases it is allowed to draw up a check by hand (but it will have legal force if it contains the required information about the purchase).