A cash receipt is a document that confirms the purchase of a product.

Having it, you can easily or exchange a purchase if defects are found on it.

Outwardly, this document is no different from a regular rectangular paper strip. That is why many buyers are skeptical about checks and throw them in the trash soon after making a purchase.

Dear readers! The article talks about typical ways to solve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

(Moscow)

(St. Petersburg)

(Regions)

It's fast and is free!

The purpose of the document and the rules for its use

Domestic law states that the buyer has the right to return or replace a low-quality product if he provides a witness who confirms the fact of purchase.

But not always a person can fulfill such a requirement of the law. And then a cash receipt "comes" to his aid, which is a "silent" witness to the purchase of goods.

Cashier's check is fiscal document, which is printed on special paper using . The seller issues this document to the buyer not when he wants it, but after each purchase, as required by law.

Particular attention should be paid to storage rules such checks. Since the text on such documents tends to fade, it is best to keep them separate from other documents. It is even better to make notarized copies of checks when the text is still clearly visible.

Features of use for individual entrepreneurs and LLC

If an entrepreneur uses the system, then he may well do without a cash register. He is required to keep only a book of accounts.

But when it comes to the acquisition of goods by a legal entity, here you can’t do without a cash receipt. Moreover, not only cash is issued, but also.

An LLC can also do without a cash register if it applies the UTII taxation system. But when the buyer asks for information regarding the purchase, the management of the LLC must do this.

If you have not yet registered an organization, then the easiest this can be done using online services that will help you generate all the necessary documents for free: If you already have an organization and you are thinking about how to facilitate and automate accounting and reporting, then the following online services come to the rescue, which will completely replace an accountant at your plant and save a lot of money and time. All reporting is generated automatically, signed with an electronic signature and sent automatically online. It is ideal for an individual entrepreneur or LLC on the simplified tax system, UTII, PSN, TS, OSNO.

Everything happens in a few clicks, without queues and stress. Try it and you will be surprised how easy it got!

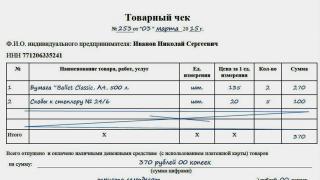

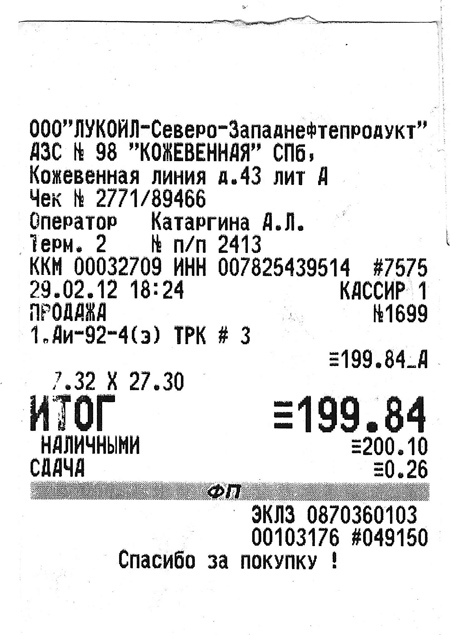

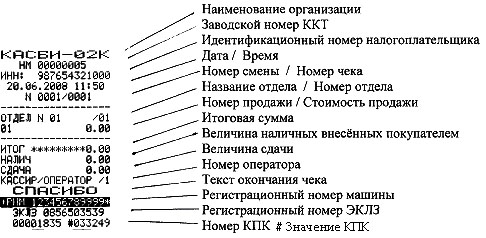

Mandatory details and their decoding

A cash receipt is a document, so it is logical that it has its own required details, namely:

- Name of the organization. The name of the company is indicated by the one indicated in the organization. If the goods are purchased from, then instead of the name of the organization, it is necessary to indicate the name of the individual entrepreneur.

- TIN of the taxpayer. This code consists of 12 digits, which is assigned by the tax authority during registration.

- Cash register number. This number is located on the body of the device.

- The serial number of the cashier's check. Before the number, as a rule, such words or signs are written as "CHECK", "MF", "№" or "#".

- Date and time of purchase. The date of purchase is indicated in the format "DD.MM.YYYY".

- Purchase cost. Specifies the amount spent on the purchase of goods.

- Sign of the fiscal regime. Such a regime can be reflected in many ways, but the phrase "FISCAL CHECK" or the abbreviation "FP" is usually used.

On a cashier's check can be specified and additional information - change, the name of the cashier, as well as the name of the goods. Although these data are not mandatory, they greatly facilitate the work of an accountant in creating analytical accounting.

Design rules

A cash receipt is a fiscal document that confirms cash and non-cash payments. Such a document is printed only in automatic mode using a cash register.

Each check contains mandatory details, the decoding of which is given above. The placement of details depends entirely on the model of the device. The only requirement for the seller is a good visibility of the text on the receipt. It may also contain other information: additional details or data on current discounts and promotions.

Make sure that the names of the listed goods on the check do not differ from the names of the same commodity items in the warehouse. If such a difference in the name exists, then discrepancies will soon appear in the following accounts - warehouse, accounting and management.

None of the technical requirements for cash registers mention that the size must be indicated on the check. But still, it is recommended to place the amount of VAT on the form of a cash receipt. It can be indicated by the total amount for all purchased goods. Thanks to this, the client will be able to see the amount that will be deducted for value added tax.

An example of printing a check on a cash register is presented in the following video:

Innovations this year

Most recently, the President approved the amendments to the law "On the use of cash registers."

Here is a list of the most major amendments:

Here is a list of the most major amendments:

- The scheme of cooperation between tax authorities and trade organizations has changed. Now data on checks will be transferred to the tax authorities online.

- Customers will continue to be issued paper cashier's checks, but if desired, the customer can request to send an electronic sample of the check to his email address. In this case, the electronic version of the check will have the same legal force as the paper sample.

- The changes will also affect cash registers. Now they will use a fiscal drive, with the help of which data on each information will be transmitted to the operator of fiscal data. The same fiscal drive will allow you to send an electronic sample of the check to the buyer.

- Simplify the checkout process. You no longer need to go to the technical service center to register the device. The entire procedure will be carried out online.

- The amendments will also affect legal entities and individuals who use the USN and UTII taxation systems. From July next year, they will also have to install cash registers without fail.

- The list of required details for a cash receipt will change. After the law comes into force, the following details will appear on the check:

- information about which taxation system the seller uses;

- serial number of the device;

- web address of the fiscal data operator;

- place, date and time of the purchase;

- calculation type - income or expense;

- name of commodity items;

- the amount payable and the amount of VAT;

- e-mail address and phone number (for an electronic check sample);

- type of payment - electronic or cash.

But for legal entities and individuals, it is important not only the rules for issuing a cash receipt, but the norms for issuing its copy.

Procedure for issuing a copy of a cash receipt

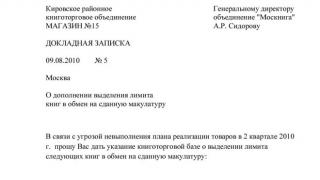

A copy of the cash receipt is not the main document confirming the fact of acquisition.

It is only considered as an additional guarantee of the interests of the buyer.

Copy of cash receipt consists of the following details:

Copy of cash receipt consists of the following details:

- document's name;

- name of the organization or full name of the entrepreneur;

- TIN number assigned by the tax authority;

- list of purchased goods;

- the number of goods for one heading;

- amount per unit of goods;

- the cost of all units of goods of one heading;

- position and full name of the person who issued a copy of the check.

The completed copy of the cash receipt must contain the seal of the organization or individual entrepreneur, as well as the personal signature of the employee who was involved in the execution of this document.

Penalties for violation of use

To the most common violations use of cashier's checks should include:

According to paragraph 2 of Art. 14.5 Administrative Code for malformed cash receipt there is a fine for the amount:

- 1500-2000 rub. for citizens;

- 3-4 thousand rubles for officials;

- 30-40 thousand rubles for legal entities.

And if the buyer does did not issue a check , then the amount of the penalty will be as follows:

- 1500-3000 rub. for citizens;

- 3-10 thousand rubles for officials;

- 30-100 thousand rubles for legal entities.

It is worth noting that in the future the Ministry of Finance plans to increase the amount of fines for non-issuance or issuance of an incorrectly issued cash receipt.

An act on an erroneously punched cashier's check. Purpose and design rules

If the cashier punched the cash register by mistake, he needs to fill out act KM-3. Its uniform was unified by the government at the end of 1998.

When filling out the act, it is indicated the following information:

When filling out the act, it is indicated the following information:

- Name of the organization;

- cash register model, as well as its registration number and manufacturer's number;

- Full name of the cashier who fills out the act;

- the number of the erroneously punched check and the amount on it;

- the total amount of checks to be returned.

All checks for which a refund is issued must be attached to the completed act without fail. Each of them must be stamped "REDACTED" and the signature of the head.

This act is issued in only one copy. It must be signed by members of the commission, and then approved by the head of the company. Together with the returned checks, the KM-3 act is sent to the accounting department. There it should be stored for 5 years.

Filling out the KM-3 act is carried out at the end of the same business day when the check was broken by mistake.

In case of incorrect filling of the act, an administrative fine may be issued. A fine may be applied if 2 months have not passed since the execution of the act.

The procedure in case of an erroneous execution of a cash receipt is presented in the following video lesson: