Despite the ease of execution, a sales receipt (TC) is an important document for participants in trade relations and authorities that control these relations.

There is an opinion that a sales receipt is a useless paper that is becoming a thing of the past as a result of the advent of modern cash registers that print the necessary payment information on a cash receipt. Maybe someday the sales receipt will lose its value. But, today the obligation to have it is assigned to the majority of entrepreneurs by law. And there are a number of reasons for this.

What is TC

This is a document that certifies the fact of payment for the purchase. It can be an addition to a cashier's check or be the main payment document that is issued as a replacement for a cashier's check. A sales receipt is issued in order to protect the rights of buyers and to prove the intended use of the money received from the report.

It does not belong to strict reporting forms, as it plays an auxiliary role and contains detailed information about the payment for the goods: the name of the seller, the taxpayer number (TIN), the date of sale, the name of the product, the number of units, etc.

Form and required details

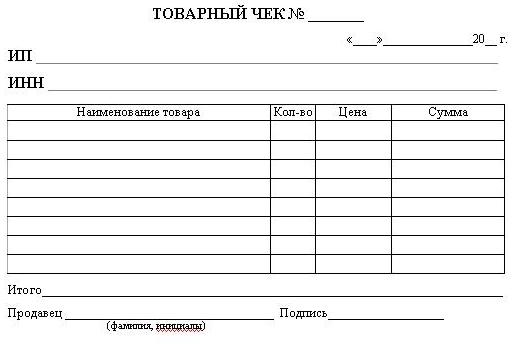

This check does not have a unified form. Therefore, an individual entrepreneur has the right to develop a special sample of this document for his enterprise.

Most importantly, it must contain the following details:

- document's name;

- the date of payment;

- number in order;

- name of the organization (full name of IP);

- identification number of the taxpayer (organization or individual entrepreneur);

- the name of each product sold;

- the number of units of goods sold;

- the cost of a unit of goods;

- the final amount of the payment;

- position, full name and signature of the seller.

Filling rules

Filling rules

This document is not a strict reporting form, but refers to financial documentation, so the proper execution of a sales receipt is very important.

In the appropriate columns of the form, detailed information about the paid goods, services or work is written. If the name does not fit in one line, then they transfer to the next one.

The total amount of the purchase is indicated in numbers and in words. For this, a special line is allocated at the bottom of the form.

The last line is intended to indicate the position, surname, initials and personal signature of the seller.

If one form does not fit the purchase data, then the seller continues to write on another sheet, then staples the forms, indicates the total on the last page and makes a note that this is a single document. Or splits the purchase into two checks, each of which contains a separate total.

If after entering the data there are empty lines, then they are crossed out in order to exclude the subsequent entry of false information.

If you make a mistake, you need to fill out a new form, and not make corrections. Since here, as in other financial papers, corrections are not allowed.

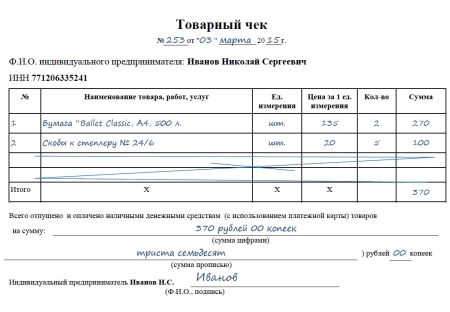

Example of correct filling

In the column "Name of goods" indicate the specific name of each item. This requirement is mandatory.

Items cannot be grouped together. So, when trading household chemicals, they do not write the general name “Household chemicals”, but single out each item: “Chistulya” washing powder, “Droplet” dishwashing detergent, “Blesk” glass cleaner, etc.

An example of incorrect filling

Do you need a print?

The legislation does not say anything about affixing a seal on this type of check. This document does not have a unified form, therefore, it must include the data given in paragraph 2 of article 9 of the Federal Law No. 129, the seal does not appear in this paragraph. Therefore, a check without a seal can be accepted for accounting. But, regulatory rules oblige organizations to use a seal in their activities, so some lawyers are of the opinion that checks issued by a legal entity should have a seal.

For individual entrepreneurs, there is no requirement for a seal, therefore, it is optional on the documents issued by them.

Although, for the entrepreneur himself, the seal imprint is a guarantee that in the event of a return of the goods or another disputable situation, there will be confidence that the goods were purchased from him.

In what cases is an individual entrepreneur obliged to write out a TC?

Individual entrepreneurs and organizations working with the use of cash registers are required to provide a sales receipt in addition to the cash receipt, if required by the buyer.

And for individual entrepreneurs and legal entities that are UTII payers, filling out a sales receipt is the main confirmation of the transaction. The same applies to entrepreneurs who are on the Patent, but only in the field of trade and the provision of other services, when it comes to confirming the provision of services to the population, a strict reporting form is issued.

For failure to issue a sales receipt, an entrepreneur, as well as a legal entity, faces a fine.

Control over the fulfillment of obligations for the issuance of this document is carried out by the tax inspectorate. The same organization imposes fines for non-compliance by entrepreneurs with these obligations.

The amount of the fine for failure to issue a sales receipt, under Article 14.5 of the Code of Administrative Offenses, is 1,500-2,000 rubles for citizens, 3,000-4,000 rubles for officials, and 30,000-40,000 rubles for legal entities.

Sales receipt for advance report

Often, entrepreneurs wonder about the need for the check in question to accept expenses. It would seem why this document is needed when modern cash registers print cash receipts with a detailed description of the transaction made between the buyer and the seller, i.e. include product names, unit price, quantity, and other details.

The fact is that according to article 252 of the Tax Code of the Russian Federation, only justified and documented costs are included in expenses. And Federal Law No. 129 states that primary documents are accepted for accounting if they have a standard form or contain the following data: document name, form number, date of issue, company name, essence of the transaction, quantitative and monetary measurement of the transaction, position and signature of the responsible person .

The details of the sales receipt meet these requirements, and it is a primary document, therefore, it is also needed, like a cash receipt confirming the fact of payment. In addition, its presence will help not only in justifying the acceptance of expenses for accounting, but also in resolving disputes during a tax audit.

Shelf life

Both the buyer and the seller must keep this receipt. But, since it is issued in a single copy, the original is issued to the buyer, and the seller, as a rule, leaves a copy for himself.

If a check is used to confirm expenses and is attached to the expense report, then the storage period as a primary document is at least 5 years.

It is desirable for an individual to keep this document during the warranty period established for the purchased product.

The seller does not have a strict obligation to keep these documents. But, by keeping copies of checks, an individual entrepreneur will facilitate accounting at his enterprise and ensure strict control over the consumption of goods, which is important when trading without cash registers.

In addition, copies of sales receipts and registers of their accounting will help to avoid unpleasant situations associated with a tax audit. Thus, according to clause 41 of Administrative Regulation No. 133n, tax inspectors have the right to demand copies of checks, their registration journals and other types of reporting related to entrepreneurial activities. Therefore, it would be more correct for an individual entrepreneur on Patent and UTII to ensure the storage of copies of these documents, as well as to keep a log book in order to avoid a possible imposition of a fine.

Thus, it becomes clear that a sales receipt, despite the simplicity of execution, is very important for participants in trade relations and the bodies controlling these relations. Therefore, its design and storage must be approached very carefully.